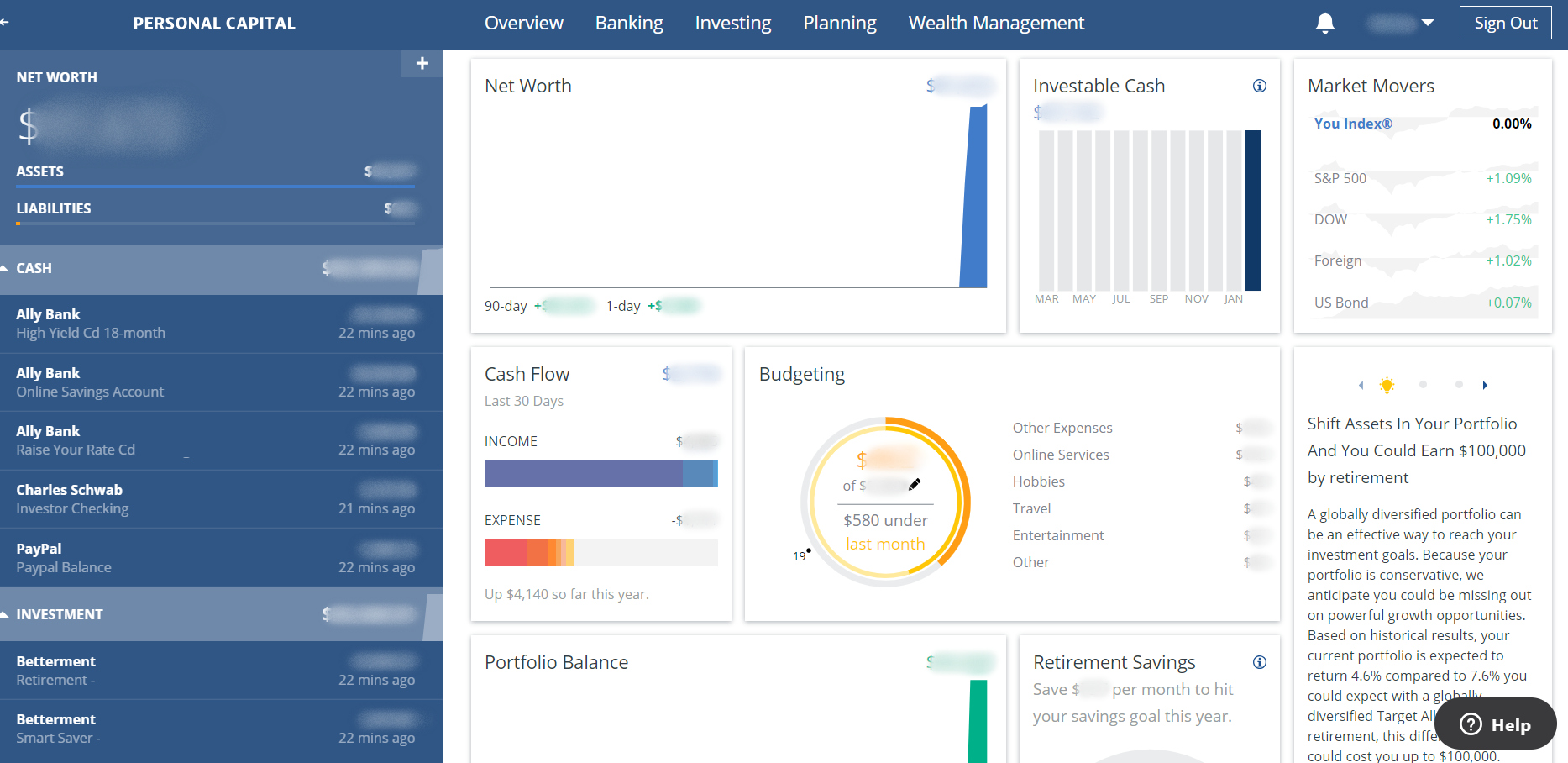

The software is available in two versions, one for Windows and another for macOS.The software tracks accounts, loans, bills, investments and budgets. Related to this Moneydance review: Personal Capital vs. Moneyspire (formerly Fortora Fresh Finance) is personal finance software and small business accounting software developed by Moneyspire Inc. Moneydance doesn’t give you some of the extra features you’ll find with some other personal finance tools, like goal setting and retirement tracking options. resident, 18 years old or older, employed full time or retired, and not currently working in sensitive industries. Respondents needed to meet the following criteria: U.S. While the software itself is on point, I wonder how many people are turned off by the overall look of the site. This survey was conducted by The Harris Poll on behalf of Empower Retirement and Personal Capital from Novemto Decemamong 2,008 respondents. This is the flip side of not focusing on design. If you have Quicken 2019, there currently isn’t a way to move your data from Quicken to Moneydance, and Moneydance says they are currently working on the issue. Moneydance doesn’t charge you any extra for bill pay, and it’s available if your financial institution supports it. Moneydance isn’t relying on looks it just does what it does best – helping you manage your money.

#Personal capital vs moneyspire for free#

Remember, you can still update to the next version for free and subsequent versions at a reduced rate, but it’s all optional. You can keep using the software year after year at no additional cost – once you buy the license for the product, it’s yours. I don’t think this is going to be a major selling point for people, but it’s worth mentioning. Don’t get me wrong, it runs quickly and smoothly, but it doesn’t look as modern as apps like Mint or YNAB. One more important thing to note before getting deeper into this Moneydance review – Moneydance has a pretty old school look. You pay a one-time fee for Moneydance, have free access to the next updated version, and then receive a discount on future software updates. It’s also not subscription-based, which is pretty different than what other paid personal finance apps are currently offering. But, you still can link and sync your accounts. It’s local software, so not cloud-based, which is good for anyone who is concerned about data breaches.

Since then, it’s gone through numerous updates and releases so users can take advantage of a growing list of features, including bill payment, budgeting, and investment tracking. Moneydance was first released in 1997… that’s over 20 years old. What is Clickfunnels & How it Can Help Your Business.Things to Look for When Choosing a Bank.

#Personal capital vs moneyspire how to#

How to Find Virtual Assistant Jobs for Beginners.Work from Home Jobs with No Startup Fee.

0 kommentar(er)

0 kommentar(er)